How We Frugal-ed in June 2023

Family Balance Sheet

JULY 10, 2023

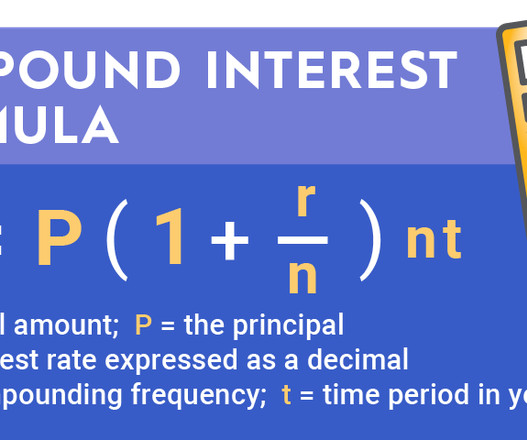

2 – We opened up high-interest savings accounts and earned $250 in interest. We are in what I call our “shovel season of life” Our oldest daughter leaves for college in the fall of 2024 and we have a big savings goal to hit before then. In total, we have made $250 in interest since April.

Let's personalize your content