Tax season is upon us, and everyone wants to know: What is the best tax software? Is there a way to file for free online? Is it worth it to pay a little more money to get in-person help? Let’s compare two popular options, FreeTaxUSA vs Liberty Tax, and see which one is better for you.

Filing taxes can be complex. In addition to compiling your income, you must also compile expenses and items for which you can claim deductions: student loans, child tax credits, business expenses (if applicable), and the like.

Comparison Overview

| Feature | FreeTaxUSA | Liberty Tax |

|---|---|---|

| Type | DIY Tax Preparation Software | Tax Preparation Service & Software |

| Federal Return Cost | Free | Starts at $55.95 |

| State Return Cost | $14.99 | Starts at $36.96 |

| Overall Rating | 4.8 out of 5 stars | 4.6 out of 5 stars |

One concern that many taxpayers have is maximizing their refund. They want to work with a tax preparation service or use tax prep software that will help them get the most back. Part of that comes down to the ease of using the online interface, and part of it comes down to the customer support and assistance the company can offer you.

⭐ About FreeTaxUSA

FreeTaxUSA is not a tax preparation service like H&R Block. It’s a do-it-yourself, no-frills tax preparation software. Despite its simplicity (or perhaps because of it), they have been rated 4.8 out of 5 stars by those who have used it for tax filing, which is a fairly excellent overall rating.

FreeTaxUSA Pros

- Your federal return really is free

- Your state return is only $14.99

- No upselling: what you see is what you get

- Freelancers, contractors, and business owners also enjoy the free edition

FreeTaxUSA Cons

- “Deluxe” support is chat only

- Phone-based support costs nearly $40

- No frills really means no frills: this is DIY

⭐ About Liberty Tax

The Liberty Tax franchise makes itself known with street-side sign wavers dressed as Uncle Sam and Lady Liberty. They’re representing Liberty’s brick-and-mortar tax preparation services. But Liberty Tax also has online tax software you can use from home.

Liberty Tax Pros

- Accuracy Guarantees

- Maximum Refund Guarantees

- Faster tax refunds with the Deep Blue Debit

- 2,500 Office Locations Around the United States

Liberty Tax Cons

- No free packages

- State returns are nearly $40

- Filers with dependents forced into deluxe packages

⭐ Tax Products: FreeTaxUSA vs Liberty Tax

Overview

| FreeTaxUSA | Liberty Tax | |

| Basic | Federal: $0, State: $14.99 | Federal: $55.95, State: $36.96 |

| Deluxe/Premium | Same pricing, adds features for complex situations | More expensive, adds features for investments, business, etc. |

What Does FreeTaxUSA Offer?

“No frills” sums up FreeTaxUSA perfectly. The prices are very clearly stated on their website. Let’s start with what “free” really means.

| Basic | Advanced | Premium | Self-Employed |

| Step-by-step guidance

Maximum refund, fast Beginner-friendly |

Maximize credits and deductions

Homeowners Earned income credits |

Investments

Rentals Sale of primary residence |

Small business owners

Freelancers Contractors Gig workers |

| Federal: $0 | Federal: $0 | Federal: $0 | Federal: $0 |

| State: $14.99 | State: $14.99 | State: $14.99 | State: $14.99 |

These pricing points are (to put it casually) kind of amazing. Most tax preparation software will funnel those with a more complex tax situation out of the free edition and into “deluxe” and “premium” packages. A FreeTaxUSA vs TurboTax comparison, for instance, shows you that while FreeTaxUSA really can be free for gig workers, TurboTax might end up costing $429.

What Does Liberty Tax Offer?

Liberty Tax offers in-person tax filing, remote filing by a tax professional, and online tax software. Remote filing involves downloading the Liberty Tax App and snapping pictures of every relevant tax form (W2, 1099, etc.) Here’s the pricing for the DIY online option:

| Basic | Deluxe | Premium |

| Federal: $55.95 | Federal: $75.95 | Federal: $95.95 |

| State: $36.96 | State: $36.96 | State: $36.96 |

| Single filers

Married with no dependents |

Dependents

Investments Various tax credits |

Business owners

Freelancers Contractors Investors |

The obvious downside to Liberty Tax online is that there is no free tax preparation. Even the least expensive option is going to cost you nearly a Benjamin (unless you live in a state with no income tax). Their website also does not list the Liberty Tax service in-person prices. These will cost more, and vary based on the complexity of your return. However, Liberty does offer discounts on filing, so you should ask if there are any coupon codes you could use.

⭐ What Tax Services Do They Provide?

FreeTaxUSA

Here are the guarantees offered by FreeTaxUSA:

Maximum Refund: if a different software gives you a larger refund or a smaller tax liability, FreeTax will refund any fees you paid and redo your return. However, this difference must not be attributable to any illegal calculations. If you’re wondering what “fees” there are for $0 tax filing and $14.99 state returns, we’ll get to that in the next section.

100% Accuracy Guarantee: If FreeTaxUSA makes some sort of mistake that results in you paying fees, fines, and penalties to the IRS, the company will pay the penalties and the interest.

There is a 45-day statute of limitations on this and you must notify them in writing at:

FreeTaxUSA: Accuracy Guarantee

1366 East 1120 South

Provo, UT 84606

🔥 Hot Tip: FreeTax offers an audit defense sort of “insurance policy” for $19.99.

LibertyTax

Not to be outdone, Liberty Tax also offers some bells and whistles:

- Liberty offices are open all year round and can always provide free copies of your return.

- Audit Assistance: If (in the rare instance) the IRS audits you and someone from a local office prepared your return, that tax professional will accompany you to the audit.

- Liberty will assist you in replying to any correspondence your get from the IRS.

- Select locations will provide free consultations.

- Accuracy Guarantee: if you get a larger refund somewhere else, Liberty will refund your tax prep fees. If an error in preparation results in fees, fines, and penalties, Liberty will pay those as well.

⭐ Who Has the Best Customer Service?

FreeTaxUSA

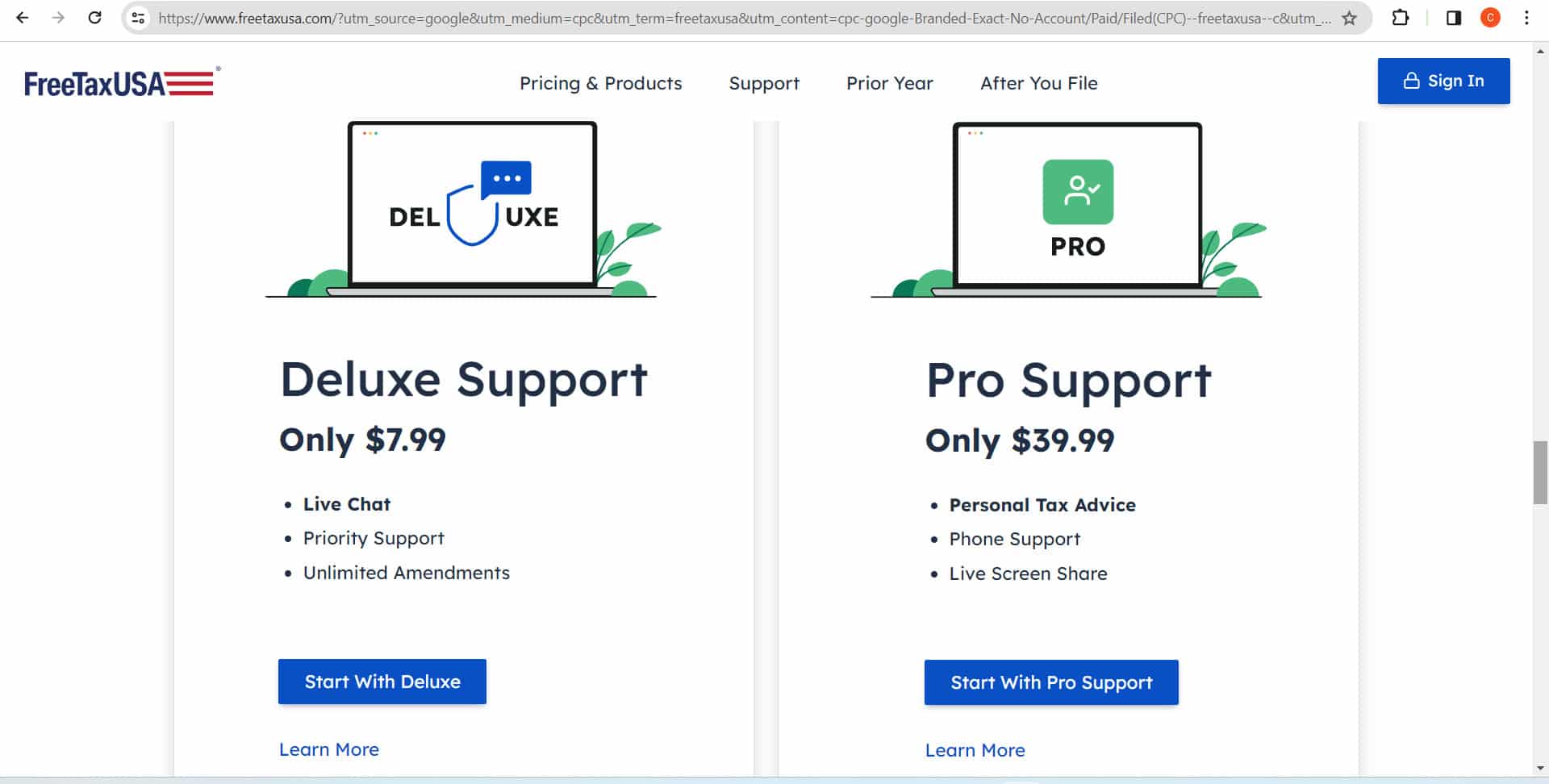

FreeTaxUSA charges for customer service, for better or worse. Deluxe support comes with live chat accessibility. Considering that the return is already $0 and the state return is $15, adding $8 to your total isn’t that bad.

You might as well splurge for the phone-based support package with Pro Support at $40. This does allow you to ask questions and seek personal tax advice from a tax professional. Consider that the pro support package and state return costs are going to be less than Liberty’s most basic return.

The live chat is available from January 4 through April 30, Monday through Saturday from 9:00 AM to 11:00 PM EST. From May 1 to December 31, it’s available weekdays from 10:00 AM to 9:00 PM, EST.

The phone hours for Pro Support are January 4 through April 30, Monday through Saturday from 10:00 AM to 9:00 PM EST. From May 1 to December 31, it’s available weekdays from 10:00 AM to 8:00 PM, EST.

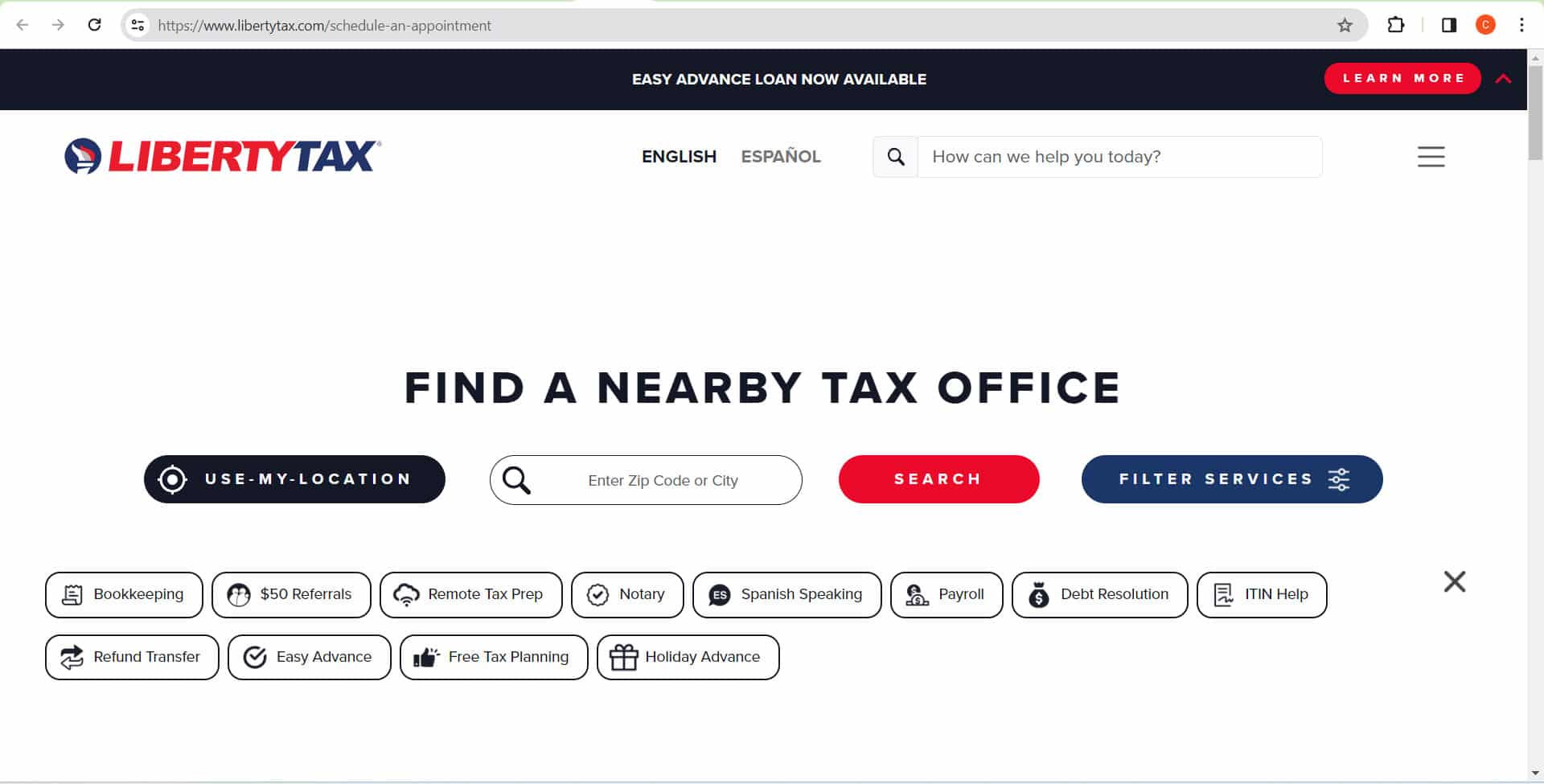

Liberty Tax

Calls are routed to your local tax office. You can call 1-866-305-3126 to get connected to a tax professional. You can also use the office locator on the website to make an appointment. Walk-ins are also welcome.

The online locator will also give you the hours for the individual office locations (if you’re wondering when you can call).

Online support is available from 9:00 AM to 5:00 PM on weekdays. You just need to email your inquiries to libertyonlinesupport@libtax.com.

⭐ Refunds

Overview

| FreeTaxUSA | Liberty Tax | |

| Speed | Standard IRS times | Options for faster access via products |

| Advance Options | None specified | Easy Advance up to $6,250 |

FreeTaxUSA

You’ll get your refund with FreeTaxUSA, and they even have the above-mentioned guarantee. However, there are no special advances or loans with the refund, which are offered by other companies such as Liberty Tax.

There are several ways you can get your refund. You can get a check cut from the IRS directly. You can have the IRS do a direct deposit ACH into your bank account. Or you could pay $24.99 to cover the cost of your tax filing (instead of paying upfront).

If you’re wondering what this means, it refers to the extras that do cost more than $0, like the state filing and customer support. The $24.99 is an additional service charge to allow these items to be deducted from your refund if you can’t or don’t want them to be paid for upfront.

Liberty Tax

The refund process is where Liberty Tax shines. For starters, there is a unique Easy $100 Loan. This no-interest, no-fee loan is secured and repaid by your tax return. It’s not a huge amount, but if you want $100 the day you file, this will do. However, the wording of the website seems to indicate this is an in-person-only offer. Knowing that in-person filing may cost more, it could possibly be viewed as an advertising gimmick to get some customers in the door.

But wait: there are more enticing Liberty tax refund options. There is the Easy Advance, which can provide you with anywhere from $500 up to $6,250. In order to get that maximum amount, your refund must be equivalent to $8,400 or more. This is essentially a loan, so it will have finance charges and an interest rate. You can receive your money three ways: a paper check right in the office where you apply, direct deposit to your checking account, or have it deposited into a Deep Blue debit account.

Deep Blue is essentially a checking account managed by Liberty. Even if you don’t get the Easy Advance, electing to have your refund sent to a Deep Blue account means you could receive it as many as 5 days earlier. In terms of long-term appeal, Deep Blue savings accounts offer an APY of up to 6.00%, which is phenomenally high compared to most banks.

⭐ What if You Owe the IRS Money?

You do not need to pay your tax bill to Liberty Tax or FreeTaxUSA. You need to pay your tax bill to the IRS. You can do this right on the IRS website using a credit card, debit card, digital wallet, or ACH transfer. Take note that debit cards and credit cards are charged fees. There are three payment processors the IRS uses to collect payments:

| PayUSATax | Pay1040 | ACI Payment Inc. |

| Debit: $2.14 | Debit: $2.50 or 1.87% for certain debit cards | $2.20 |

| Credit: 1.82% | Credit: 1.87% | Credit: 1.98% |

You will need to look at the IRS page linked above to see which payment processor can facilitate the type of debit or credit card you want to use.

Keep in mind this is only for your federal tax return. If you owe state taxes, you’ll have to pay through the website of your state comptroller. A quick Google search for “pay my state taxes” will pull up the site.

In some states, the department that handles tax payments is the Comptroller, in others, the Franchise Tax Board or Department of Revenue. Whatever your state calls it, make sure the website ends with a .gov extension so you know you’re on an official site.

When filing individual returns online, at the end of the process you may be prompted to click on links to some of these sites to pay your taxes right away. You can do that if you’d like. Alternatively, you could send a check to the IRS or make a payment on IRS.gov.

⭐ So… Which is Better: FreeTaxUSA or Liberty Tax?

There’s no doubt about it: if you’re confident about doing your own taxes and you don’t mind waiting 21 days to get your refund directly deposited, FreeTaxUSA is a good choice. Even if you pay for the most deluxe customer support option, it’ll cost you less than Liberty Tax or when comparing TurboTax vs H&R Block.

You can file your taxes online at a very low cost, but support will be pretty hands-off. With no walk-in retail offices, you may also find that even the most deluxe package is not as helpful as you’d like it to be.

On the other hand, if you’d like a little more support, Liberty Tax may be the best place to get your taxes done cheap. They also have the option of advancing your tax refund. When it comes to user experience, Liberty Tax may also be the best tax software of the two. The fact that they have a phone app for easy uploading of tax forms goes a long way.

Overall Recommendation:

✰ FreeTaxUSA is best for those confident in DIY tax preparation looking for a cost-effective solution.

✰ Liberty Tax suits those seeking in-person support or faster refund options despite higher costs.

To summarize: if you’re confident about doing your taxes and don’t mind waiting for your refund, FreeTaxUSA is the best for filing taxes. But if you’re feeling a little unsure about the ins and outs of tax law, or the complexities of filing business returns, we recommend the services provided by Liberty Tax.