Hey everyone! Today we’re meeting a reader who only found my blog a few months ago; I love that she already volunteered to do a Meet a Reader post.

Here’s Andrea:

1. Tell us a little about yourself

I’m Andrea, I’m in my 20s. I live in the Midwest with my fiancé (soon to be husband in March!), two cats that look identical but are not biological siblings, and one unruly golden retriever.

My wedding dress, thrifted!

I have an English degree and I work in scholarly book publishing as an editor (developmental and acquiring editor, not the grammar and spelling kind of editor). I mostly work remotely which is very, very nice.

The cats

In my free time, I (probably obviously, considering my career) love to read, and I’m in a local book club. I just received my 200 hour yoga teacher training certificate, and I look forward to teaching yoga in the future!

I also love to visit family (all our family is between 2 and 4 hours away) and friends, bake, and play board games.

Playing board games with friends

I really don’t like crafts, despite years of attempting scrapbooking, knitting, etc, but I do like advising on my fiancé’s woodworking projects. He’s made furniture, a mug shelf, a catwalk, bookshelves, and much more!

The mug shelf

2. How long have you been reading The Frugal Girl?

Only a few months! I’ve been a years-long reader of Frugalwoods, and I think that a Frugal Girl article on piano playing popped up as a recommendation based on my membership in the Frugalwoods Facebook page.

I’ve since spent much time going through the archives.

3. How did you get interested in saving money?

I got into minimalist content in high school, and somehow found Dave Ramey through there just before I went to college.

Over the years I’ve developed my personal philosophy of money and lifestyle through a combination of minimalism and simple living content, the FIRE movement including Frugalwoods and The Simple Path to Wealth, Dave Ramsey.

4. What’s the “why” behind your money-saving efforts?

Currently, my fiancé and I are working to pay off the house early. Our long-term goal is to retire in our 40s, and the first step is to pay off this mortgage (in addition to recommended retirement investing).

We aren’t interested in the aggressive investing that is often common in the FIRE movement, but rather creating an enjoyable life below our means, and saving the difference.

He wants to retire early so he can do more woodworking, electronic fixing, and maybe work at a winery or brewery part-time.

Our dog

I don’t plan to fully retire, either. I would like to pursue higher education in some way, maybe a History PhD, or a library science degree? I haven’t decided yet.

All I know is that academia doesn’t seem to me to be stable or secure enough as a primary career for me, but I do not want to completely write off a potential future of research and writing.

Essentially, we’re saving up a nest egg so that we have future freedom!

5. What’s your best frugal win?

My college education.

I went to a unique program at a state university where my tuition was fully funded, and I also received a lot of attention from faculty. The interim dean introduced me to the internship at that college that led to my current career. I got a lot of bang for my (nonexistent!) bucks through that program!!

6. What’s an embarrassing money mistake you’ve made?

This is recent. Last year I bought a manual car for $14k in cash, thinking I would learn to drive manual. (Manual cars are generally cheaper than automatic and have better gas mileage because they are lighter weight).

My dad taught my mom how to drive manual, my uncle taught my aunt, my fiancé even taught his ex how to drive manual. I really assumed I would get it. And I did learn, but I utterly DESPISE driving manual!! Everyone said “it’s so fun, it’s like driving a race car, you really get to be active in driving, etc. etc”. Well, I never wanted to be a race driver.

So, I sold the car to a friend for $12k in less than six months of owning it, and then went back to the same dealer and bought almost the same car, except in automatic for $18k.

(The manual was a 2016 Impreza with 98k miles, and the automatic was a 2015 Subaru Crosstrek with 66k miles, for any car enthusiasts. Though, I don’t think there are many here based on other Meet the Reader Posts haha).

So, I lost $2k on the sale and ended up with a more expensive car in the long run. But it’s a car I’m willing to drive, so I’ll take it!

7. What’s one thing you splurge on?

I guess automatic cars LOL.

But also, yoga. I started simply doing free Youtube classes with a Walmart mat. I even cleaned the studio for 6 months in exchange for free classes!

But now that I’ve progressed in my practice these 5 years, and have the room in my budget, I have a $130 mat, a few sets of nice yoga clothes, and $2500 teacher training.

It’s all worth it to me, this practice has been extremely beneficial for my mental and physical health.

8. What’s one thing you aren’t remotely tempted to splurge on?

Race cars? LOL.

9. If $1000 was dropped into your lap today, what would you do with it?

Put it towards mortgage overpayments.

10. What’s the easiest/hardest part of being frugal?

Easiest: Giving up things that don’t align with my personal values. It’s not hard for me (anymore) to avoid expensive stores or fast fashion sites such as Shein and Temu, and instead shop at thrift stores or use my local BuyNothing group.

Hardest: I find it hard to balance saving money with making memories. The book Die with Zero has really affected my mindset on this. I’m working to allow myself to spend money on experiences that I value, and determining exactly what those experiences are.

Concerts, I learned I don’t really enjoy, but I do love musicals and plays, so I’ve started asking for tickets as birthday or Christmas presents. I love travel, but more so because I like trying new foods and spending time with loved ones.

I don’t need an expensive cruise to satisfy this itch but getting an AirB&B a couple hours away with friends for a weekend will make some really amazing memories.

11. Is there anything unique about frugal living in your area?

One of my friends in my book club lives about 20 minutes from our city limits and does not have access to a free library membership! I was ASTONISHED, I thought everyone had access to a library.

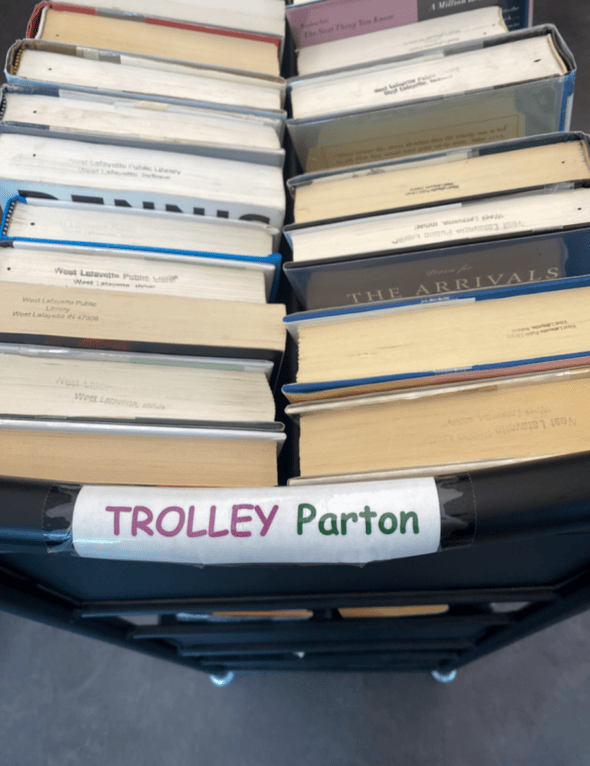

Library puns

I even have access to my childhood and college town libraries’ digital collections, in addition to my city library and county library. I read a lot, around 65 books a year, and the majority of those titles are free from one library or another.

I’m also really lucky that my social circle does not pressure AT ALL to “Keep up with the Joneses”. This same book club does a secondhand white elephant exchange at Christmas time, where all items must be sourced secondhand (through their own collections, thrift store, BuyNothing, etc) and no more than $10.

I love it.

12. What frugal tips have you tried and abandoned?

I now eat lean meat (chicken, turkey, fish).

For a while after college, I was vegetarian and relied on beans and dairy for my protein, but it was not enough for my 5’7, active frame. On the advice of a registered dietician this year, I drastically increased the protein in my diet.

This has increased our grocery bill but has also led to major health benefits that I think are worth it.

13. What’s your funniest frugal story?

Even though I had a car at the time, a friend and I took a bus to a nearby big city (about 2 hours away) for a weekend trip, because she is European and convinced me public transportation is amazing.

Well. The bus trip there was uneventful, but on the way back our bus was delayed by over 3 hours, meaning that we didn’t get home until after 2am. I vowed to never trust my sleep schedule with the Midwestern public transportation system again.

(I did get to experience European public transportation with this same friend later, and I entirely understand her advocation for it haha. The Midwest has a lot to learn!)

14. What single action or decision has saved you the most money over your life?

I think not wearing makeup has saved me a lot of money (and time) and will continue to do so.

I grew up during the height of beauty culture on Youtube, and during my teens I was definitely influenced into buying makeup I did not need. In college, I made the decision to stop wearing makeup (for a variety of reasons).

15. What is something you wish more people knew?

I think many of the biggest frugal wins in my life have come through letting other people advise me.

I went on an amazing trip to Europe with that friend for two weeks, where we stayed with her family and used public transportation, and generally lived like locals. I only got to experience that trip because a coworker introduced me to that European friend, and I took them up on that offer of introduction.

Small joys, the sunrise in our backyard

I had an amazing college experience, but I only knew about that program because I took the advice and recommendations of my advisor in high school, and I also took the recommendations of faculty members for internships and student organizations.

I think what I’m saying is, I’ve learned that many of my frugal “wins” were not my original ideas, but rather advice and recommendations I took from other (trusted!) people.

Now, I wouldn’t take financial or life advice from someone trying to sell me something, but academic advisor, coworkers, family friends, etc, are all vetted individuals I trust.

16. How has reading the Frugal Girl changed you?

I’ve started leaning more into baking! I recently made the blueberry bread recipe for my yoga cohort, and I’m making the cheesecake recipe for my fiancé for Valentine’s Day.

Cupcakes I baked

17. Which is your favorite type of post at the Frugal Girl and why?

I LOVE Five Frugal Things.

I think it is so important to celebrate the small wins while working towards larger savings goals. Similarly, I really appreciate the posts on contentment and gratitude, and often re-read those for motivation.

______________

Andrea, it was lovely to meet you. I’m so impressed with how you and your fiance are setting yourselves up so well at such a young age. Good for you guys!

I am curious…if you feel comfortable sharing, I’d love to hear more about your no-makeup decision.

I think your wedding dress is lovely! Do you plan to wear it regularly even after the wedding? Since it’s more on the casual side, it seems like it could be worn on many types of occasions other than a wedding.

Readers, the floor is yours!

P.S. If you want to participate in this series, just drop me an email (thefrugalgirl@gmail.com) and I’ll send the questions to ya.

Ally

Thursday 15th of February 2024

I agree with a lot of the no makeup perspectives but I wear minimal makeup for professional reasons. My job as a scientist does not require it, but I have found (and I think studies have shown also) that women are perceived more positively and considered more competent when they wear some makeup. As I grow older and move into leadership positions it has become more important actually because older women also tend to be more invisible to society. Just adding another perspective to this interesting discussion!

Selena

Wednesday 14th of February 2024

Call me getting old, cranky, or pragmatic but FIRE isn't what it is cracked up to be. You'll still need health insurance (dental/vision a bit easier on the pocket book but dental can add up). The ACA does exist but I just don't trust the lunatics in charge of the asylum. We paid off our house early BUT every six months *please* check with your mortgage holder that extra payments were applied to principle (make sure to write it on the memo line of the check/e-check and enclose a note to that effect if snail mail). At first I did not check - extra payments not applied properly. Person at the bank did not fix it right the first time - she had to reverse off *all* payments going back to the first incorrect and reapply properly. AND forgot to 'check the box' to no report to the credit bureaus (which didn't affect us since we weren't borrowing any money). I'd kill (well not really) to have a stick shift again but the better half's knees can't take it. Subaru is good choice, manual or not.

Selena

Wednesday 14th of February 2024

@Andrea - Midwest person here too.

Central Calif. Artist Jana

Wednesday 14th of February 2024

Andrea, thank you for sharing your intentional, non-drifting sort of life, which seems remarkable for someone in her 20s.

I only drive 3-pedal cars and am worried that I won't be able to find one (must be Honda or Toyota) when my current one croaks. It is so interesting to read all on the Commentariat who hate manual transmissions!

About makeup: isn't it amazing to see how fake eyelashes are now considered normal by all women on teevee? And those puffed-up lips. . . yikes. I'm fine with waterproof mascara, and will NEVER wear lipstick.

Congratulations on your upcoming wedding! It will be simply perfect. (pun intended)

Erika JS

Wednesday 14th of February 2024

Andrea, so glad you shared yourself with us. Loved your points of view on education especially. It provides a solid basis for many disparate things from earning potential to ditching makeup.

Congrats on your upcoming wedding! The dress is delightfully pretty and will work afterward in lots of situations. What a coup!

I always love seeing the pets and yours are cuddly (that fur on the kitties!) and your pup has such a sincere face.

Kris

Wednesday 14th of February 2024

Andrea, you sound like you'd be lots of fun to hang out with! I'm sighing over your cats. They look so much like my dearly departed Max Cat. Are they Maine Coons? Thanks for sharing!

Andrea

Wednesday 14th of February 2024

@Kris, they are not Maine Coons, they are just rescued domestic long hairs! I think they kind of look like Siberians too