Today’s submission comes from Mary, who usually signs her comments as “Mary – Reflections Around the Campfire”…so that’s what I titled the post!

1. Tell us a little about yourself

Hello, everyone! I’m Mary, and it’s a pleasure to participate in Kristen’s Meet a Reader series. I’m in my 60’s, I’ve been married to the love of my life for 44 years and we have two adult “kids.”

Our daughter is 24 and was adopted from Eastern Europe when she was one week short of a year old. Our son is 29 and biological. He married the love of his life almost two years ago, so now we have a daughter-in-law, too. We consider her our “bonus kid” and our family is extremely close.

We all love outdoor activities, but we don’t all enjoy the same ones. Among the mix are hiking, biking, kayaking, boating, jet skiing, camping, downhill mountain biking, snowboarding, and softball.

My husband, Alan, and I live in a beautiful area of the northeast that’s full of mountains, lakes, and rivers and is popular with both tourists and second homeowners.

We live on the side of a small mountain in a quiet, rural town, but we’re less than 20 miles from a city of about 25,000 people and its shopping and dining opportunities.

I love to read (Michael Connelly, Lee Child, Linda Castillo, Paul Doiron and C.J. Box are some of my favorite authors) and I use the library to borrow both regular books and electronic resources. A few years back, I hit my all-time high by borrowing 126 books over the course of one year. Yup, I’m a voracious reader.

I enjoy blogging and biking, and I usually cycle between 15 and 20 miles a day indoors when I’m not getting out to hit a bike trail. The photos included with this post are mainly from our travel adventures.

2. How long have you been reading The Frugal Girl?

I started reading The Frugal Girl about two years before I escaped from the workforce, which was almost eight years ago. So, maybe around 2014?

I don’t remember how I stumbled onto The Frugal Girl, but I know I was attracted by the frugality aspect of it and stayed because of Kristen’s attitude toward life and the community she built. I read every post, but don’t comment often – usually some of you have already made my point for me.

3. How did you get interested in saving money?

When my brother and I were growing up, our parents didn’t have much discretionary income. I learned to save money by watching my parents. (I still remember saving my change as a kid so I could “shop” for books at yard sales.)

Although my parents never specifically taught me about finances, they lived a frugal life by necessity. Our mom stayed home to raise us kids; she went to work part-time in the local school system after both my brother and I were in school.

My dad was a blue-collar worker – a machine operator on the railroad who sometimes got laid off for periods of time in the winter. He diligently maintained our car and our house, doing all the work himself. My mom cut coupons and sewed her own clothes and mine, as well. When they got married, they bought a duplex so that the rent money from the tenant in the upstairs apartment would pay the mortgage.

I learned from the best, but I believe that a personal finance course should be a requirement for both high school and college graduation. Many people don’t have the mentors I had in my parents, and they find themselves in financial trouble as adults simply due to a lack of knowledge.

That’s not right. We, as a country, owe our young people a more comprehensive education.

4. What’s the “why” behind your money-saving efforts?

There are a few “whys” for me.

One is that Alan and I had decided even before we were married that we (1) wanted to retire early and (2) we didn’t want to wait until we retired to enjoy life.

We knew it would be a balancing act, so we were working on saving money long before the wedding.

Another “why” is that if I can save money in one area, that means I’ll have more to spend in another. Saving and spending are all about priorities, and everyone’s priorities are different.

Luckily, both Alan and I have similar views and values, and neither one of us has to spend big bucks to have a good time. We sometimes pick up bagels and coffee and take them down to a picnic table on the river. He’s a cheap date – but then, so am I.

A third “why” is that saving money is like a game to me. I enjoy playing the game and I like to win. A favorite expression in our house is, “Better in my pocket than theirs.” Alan and I are now completely retired and financially secure, but it was our frugal ways that got us here, and our habits have not changed.

5. What’s your best frugal win?

As a couple, hands down, it’s the fact that we never had a mortgage.

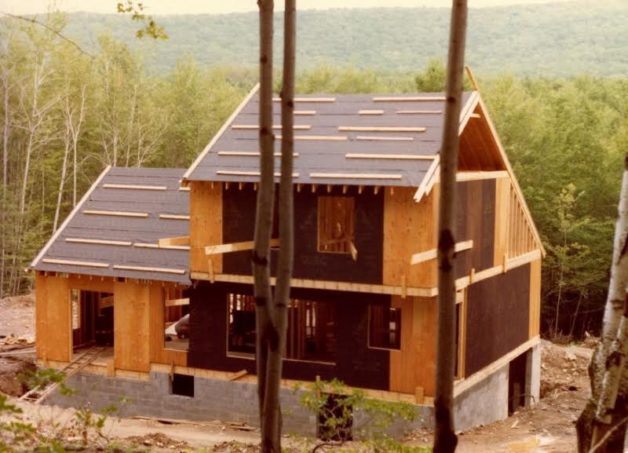

We lived off my salary and banked Alan’s even before we were married so that we could build our own house (literally), paying cash as we went. We paid an excavator (to dig the hole for the foundation), a well driller and a cabinet maker (for our kitchen and bathroom cabinets).

Aside from those exceptions, we did all the work ourselves and with the help of family. I cleared trees, mixed cement for the foundation, framed walls, and nailed sheetrock.

I didn’t shingle the roof due to a fear of heights, but Alan, his dad, and my brother did. A lot of blood, sweat, and tears were shed here, but we both agree that having no mortgage gave us a serious leg up on our retirement savings and other financial goals.

My personal best frugal win was marrying a guy who can and will fix almost anything.

Even though Alan was an IT professional by trade, his logical mind also understands what makes all kinds of mechanical things work, and he can repair just about everything I break.

I can’t even imagine how many repair bills from plumbers, electricians, appliance techs, and auto mechanics he has saved us over the years. I’ll bet the dollar amount would be staggering.

6. What’s an embarrassing money mistake you’ve made?

My biggest financial regret is the amount of money we spent on restaurant meals from the time we were married and both working full time to when we had kids. Now I wish those dollars had gone into our savings accounts.

Alan doesn’t share that regret. He says we were busy building the house and our careers and it was money well spent because it freed up our time. (We didn’t start a family until we were married for almost 15 years.)

The fact that neither one of us likes to cook and neither one of us is particularly good at it might have had something to do with it, too. Just sayin’…

7. What’s one thing you splurge on?

How about two things?

One is travel; the other is outdoor gear and equipment.

From early on, Alan and I knew we wanted to travel extensively throughout the United States over the course of our lifetime. I can see the appeal of international travel, but neither one of us ever had that particular itch.

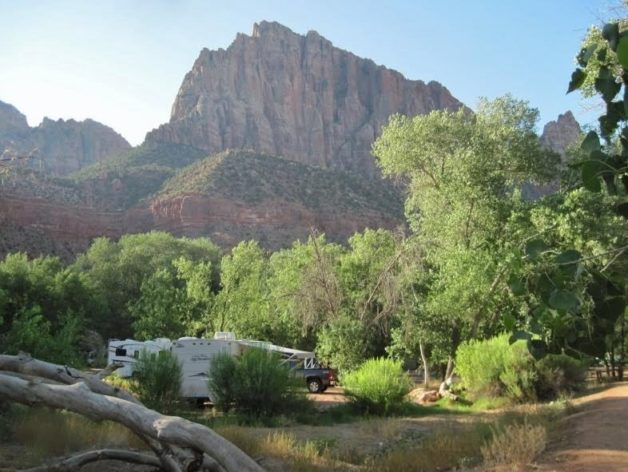

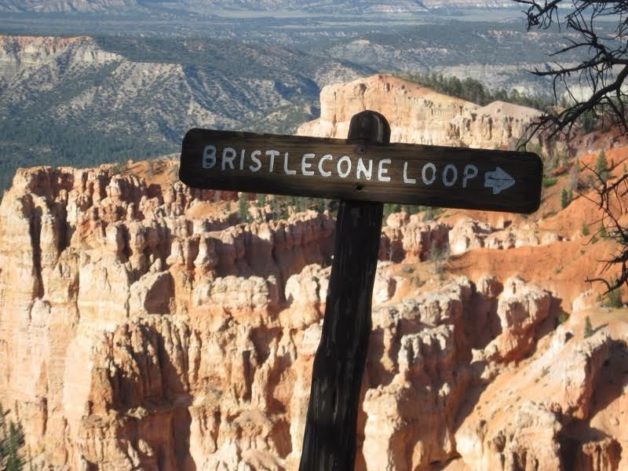

In fact, for our honeymoon, we tent camped across the country for a month in a two-person mountain tent to visit a number of iconic National Parks in the American West.

In 2007, when the kids were 8 and 13, we recreated that trip – with a travel trailer and bunks instead of a miniscule tent. Between camping and hoteling it over the years, we’ve managed to check off a LOT of items on our bucket list – including camping in every one of the 48 contiguous United States.

Since we love being outdoors, we made a conscious decision to invest in equipment that would best allow us to enjoy our outdoor activities. We’re on our second boat, our second travel trailer and we own bikes, water skis, cross-country skis and kayaks.

Over the years, the activities we’ve shared as a family have kept us connected and close, and the kids still enjoy hanging out with the old folks. Go figure.

I author a blog to document our adventures (Reflections Around the Campfire) because I enjoy creative writing and because I wanted a permanent record of our travels, especially for our kids.

8. What’s one thing you aren’t remotely tempted to splurge on?

Just one? Really? But there are so many!

- perfume

- nail polish

- makeup

- hair salons (our daughter’s a licensed cosmetologist and master barber!)

- manicures

- pedicures

- expensive or trendy clothes and shoes

- brand-name foods

- gym memberships

- a large-screen TV, streaming services, movies

- the latest phones and tech gadgets

- fine wines

- alcohol

- cigarettes

- credit card debt

The list goes on.

9. What’s the easiest/hardest part of being frugal?

The hardest part of being frugal for me is resisting the appeal of a good restaurant meal.

I enjoy good food even though I don’t like to cook it – maybe especially because I don’t like to cook it.

The easiest part of being frugal is everything else.

Besides being committed to our priorities, I’m a numbers nerd. I grew up in banking and held other finance-related positions during my working years. As an introvert, I’m much better with numbers than people, so most things related to finances come pretty easily to me.

The banking experience helped, and I educated myself on investing as a young adult. Spreadsheets are my friends. I track expenses, monitor our budget and handle all of our investments.

Because I understand finances, money doesn’t scare me. It’s a tool, and it provides security and options. Being frugal is just playing with numbers – and winning.

10. Is there anything unique about frugal living in your area?

Alan and I, by choice, bought land in an area with low property taxes.

Had we not fallen in love with the locale, it wouldn’t have mattered how low the taxes were, but fall in love we did. Part of the appeal of the area in which we live is that there are plenty of inexpensive opportunities for outdoor recreation.

Lots of hiking and biking trails, lakes and rivers for swimming, boating and fishing, delightful state parks with a $10 or less entrance fee (cheaper, still, with an annual parks pass), plus free summer concerts and family-run farms and orchards with tons of pick-your-own fresh fruits and vegetables.

We don’t have to spend a lot for entertainment.

11. What frugal tips have you tried and abandoned?

I always used to buy heads of romaine lettuce to wash and tear up for salad because it’s less expensive than buying prepped salad greens. And every week, I’d throw away romaine lettuce.

I finally wised up, and I’ve been buying prepped and packaged baby spinach and spring greens for years. Guess what! No more waste! And we eat a healthy salad almost every night.

12. What’s your funniest frugal story?

How about my most memorable frugal story?

This goes back maybe 20 years or so. We were somewhere on vacation with the kids when they were young, and Alan and I had promised them ice cream. We ended up at a Ben & Jerry’s – excellent ice cream, but pricey. When I realized that they were charging $3.25 for one single scoop of ice cream, my frugal heart almost gave out. (Don’t forget, this was 20 years ago.)

So, we pulled the kids off the line and took them aside to explain the situation: We could each buy a cup with a single scoop of ice cream there at Ben & Jerry’s that one day. Or we could go to the local Walmart where everyone could pick out an entire pint of Ben & Jerry’s for themselves that would last for several days, and we’d still have enough money left over for whipped cream and cherries.

It was a lesson they learned well – and enjoyed for the next three days.

These days, our kids are always quick to tell me whenever they score a deal, and they’ve both grown up to be good and frugal consumers.

Just over the past week, our son replaced the fuel pump and exhaust system on his truck. He spent $500 for parts, and we estimated a bill of well over $1,000 had all the work been done at a service station. He saved about 50% on his parts, too, through diligent shopping.

Made me proud!

13. Which is your favorite type of post at the Frugal Girl and why?

Five Frugal Things is my favorite because I applaud the many ways y’all creatively play the frugality game.

That’s followed closely by Thankful Thursdays because they always remind me to count my blessings. It seems that both types of posts tend to resonate with a lot of readers.

14. Do you have any tips for frugal travel or vacations?

I save money in other areas of my life so that I can spend it on travel, but that doesn’t mean I like to pay full price for anything when we’re on the road.

For outdoor enthusiasts like us, camping saves a lot of money. I ran the numbers. Even when we’re getting worse gas mileage because we’re towing the travel trailer, camping is still on average $100 per day less expensive for us than traveling by car and hotel.

Campsites are cheaper than hotel rooms, and because we can carry our own food with us, we don’t spend as much on restaurant meals.

We had the initial outlay for the travel trailers, of course, but RVing is a lifestyle choice for us, and we’ve camped enough nights over the years that the trailers have both paid for themselves. (Tent camping is even less expensive.)

Alan’s Lifetime Senior National Parks Pass allows us free entry in the National Parks we love and provides a 50% discount on camping fees in federal campgrounds. That pass is available to anyone aged 62 or older for a one-time fee of $80. We saved $105.00 on one campground alone last year.

Disney enthusiasts should check out mousesavers.com and consider shopping with the kids for Disney souvenirs at the local Walmart rather than in the parks. The same is true for Maine. Try Reny’s, a regional department store chain, for Maine souvenirs instead of pricey gift shops.

Anyone who uses credit cards to collect travel points might want to follow thepointsguy.com; the site covers a lot of territory in the travel rewards arena. I have no tips for saving on airline travel because, as die-hard roadtrippers, we rarely fly.

Booking stays through one hotel chain consistently will lead to additional points or free nights more quickly than jumping from one hotel chain to another.

Sticking with a reasonably priced hotel chain that offers free breakfasts and mini-fridges and microwaves in all rooms can easily save money, as can choosing an extended-stay hotel with a full kitchen and discounted rates for weekly stays.

Pack a cooler with your own healthy snacks and drinks to avoid paying a premium price when someone becomes desperately hungry or thirsty. (That would be me. It happens all the time.)

Most touristy areas offer coupon books with discounts for restaurants and attractions, but it’s a lot of fun to pack a picnic and just hit the beach with a few cheap sand toys, too.

Our frugal habits like to travel with us, and I’ll bet that most readers have their own ways to save on travel and vacation.

15. What is something you wish more people knew?

You don’t have to be cheap to be frugal. You don’t have to be wealthy to have a rich life.

The best experiences in life are the ones you take the time to savor, appreciate, remember, and celebrate – and they don’t have to be expensive to forever hold a place in your heart.

Kristen, I always enjoy reading your Meet a Reader posts, so thank you for allowing me the opportunity to participate!

_____________

Mary, thanks so much for joining in! As I was reading through what you wrote, I kept thinking how lovely it is that you and your husband seem so well-fitted to each other. You share priorities, interests, and desires, and I am not surprised that you are still so happy after all these years.

I smiled when I saw that you put alcohol as a splurge you are not interested in. I had not thought of it like that, but I too save money by not drinking alcohol! I just do not like the taste of it and I also don’t like the way it makes me feel, so that makes for a super-duper easy money saver. 😉

And I love that you figured out that buying more expensive salad greens is cheaper in the long run. The food you will actually eat is what is worth buying!

Ruth T

Tuesday 5th of March 2024

Thanks so much for sharing, Mary! It was a delight to read your interview. I loved your most memorable frugal story. :) That sounds like the type of thing I think about and have also talked about with my kids!

Thanks for the tip about the Lifetime Senior National Parks Pass - I'm going to let my in-laws know about that because it's the type of thing they would love. We also really enjoy camping. If we're not visiting family, we camp for vacation. I loved reading about how your kids still enjoy doing those types of things with you, because that's what I want for my kids as they get older! I was encouraged by reading about your experience.

It's great to have you as part of this community, Mary!

Mary ~ Reflections Around the Campfire

Wednesday 6th of March 2024

@Ruth T, they were one step ahead of us - good for them!

Ruth T

Tuesday 5th of March 2024

@Mary ~ Reflections Around the Campfire, That is so sweet! What a beautiful relationship. Good news: my in-laws said that they already have the lifetime pass! :)

Mary ~ Reflections Around the Campfire

Tuesday 5th of March 2024

@Ruth T, thank you for your kind words! Please let your in-laws know that the Lifetime Senior Pass is like a gift that keeps on giving. We do so appreciate the relationship we have with our kids, and it warms my heart that our daughter-in-law has said, on more than one occasion, that she enjoys hanging out with us. A couple of times a year, I like to take each of them out for lunch for some one-on-one time. It's always a pleasure, and we've had some great conversations.

Jem

Tuesday 5th of March 2024

What a lovely read! You and your husband have crafted a beautiful life for yourselves. Well done, and thank you for sharing!

Mary ~ Reflections Around the Campfire

Tuesday 5th of March 2024

@Jem, thank you! I love that you used the word "crafted" to describe our life!

Selena

Monday 4th of March 2024

Sometimes you have to spend money to save money or time - we can't make more time (or more land). So I agree with your husband. We'll have two vehicles when I retire - that will need to be maintained, licensed, and insured. But we can use year-round. But we've watched friend and co-workers who have what we call toys. And they come with expenses (even if purchased with cash) - expenses we opted to not incur. Plus some have to pay to store the toys or haul the toys. To each his/her own as the saying goes. I have a friend who was a former co-worker. She retired before age 65 in a state that did not expand Medicaid - her husband was already 65+. She knew her health insurance premiums (for sucky insurance, direct quote from her) would be high but it still sticks in her craw. I fervently hope she has no major health issues before turning 65. Early retirement, I am *not* talking FIRE mind you (a pox), is a roll of the dice. Some have retirement insurance benefits (besides a year of COBRA). Age difference between spouses/partners is another part of the equation (especially for the younger person). Glad it has worked for you. And isn't it wonderful your kids still don't mind spending time with the "parental unit". An attestation to doing your job raising them. I agree financial literacy (as I call it) should be taught in high school and college - maybe even junior high. None of us had any college debt but kids and I have seen other struggle due to it. Often I think "if only someone had spent the time before the college student signed the dotted line".

Mary ~ Reflections Around the Campfire

Tuesday 5th of March 2024

@Selena, we endured several years of expensive health insurance premiums through our state marketplace before Alan and I became eligible for Medicare. He's two years older than I am, but I continued to pay for a family plan because our daughter was still a minor at the time. Ouch, that hurt! So I do empathize with your friend.

Loy

Monday 4th of March 2024

Thanks for an interesting interview. Mary, if you are at all interested in improving your cooking, Erin Chase of 5dollardinners.com has a new book available on Amazon called Learn to Cook on a Budget: A Cookbook-Workbook Designed To Help You Find Confidence in the Kitchen with 40 Basic & Essential Video Lessons and Recipes! It is $15.99. Sounds as if you are doing OK though.

Mary ~ Reflections Around the Campfire

Tuesday 5th of March 2024

@Loy, yes, we're doing "okay," but knowledge is power and I appreciate your tip on the cookbook!

Mary ~ Reflections Around the Campfire

Monday 4th of March 2024

Kristen, this was tons of fun, and it was a real treat to interact on such a personal level with everyone who commented. Thanks, again, for the opportunity - and thanks, too, for your sweet comments about the relationship between Alan and me. Life is never without its struggles, but we've been extremely fortunate over the years and know just how blessed we are.