How We Paid off Six Figures of Debt

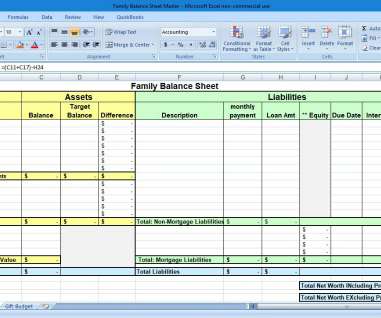

Family Balance Sheet

JUNE 22, 2020

It was so big that I cried for two days straight– we paid off six figures in non-mortgage debts. How we got to six figures of non-mortgage debt: In the summer of 2012, we found an opportunity to purchase an office building for our small business. After the first year, the new business debt weighed on me.

Let's personalize your content