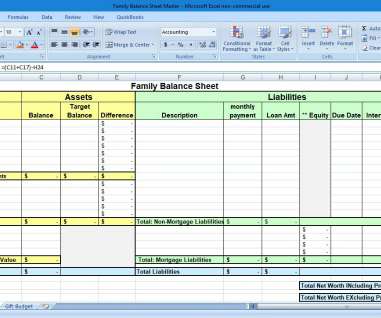

How to Create a Family Balance Sheet + Get a FREE one for your family!

Family Balance Sheet

AUGUST 21, 2020

Let me show you how to create a Family Balance Sheet. If it’s updated regularly, you will always know how much you OWE and how much you OWN. You’ll know how much is in your checking and savings accounts and your retirement accounts. Need a quick snapshot of your finances? I STILL use our spreadsheet today.

Let's personalize your content