Debt Consolidation Calculator | Bankrate

Savings Corner

DECEMBER 24, 2023

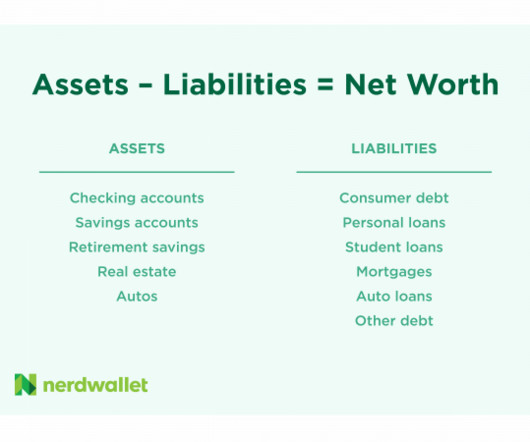

How to use a debt consolidation calculator to control your debt It is easy to get overwhelmed with debt, but debt consolidation offers a solution. Bankrate’s debt consolidation calculator is designed to help you determine if debt consolidation is the right move for you.

Let's personalize your content