40% Off Regolden-Book Budget Planner – Undated Monthly Bill Organizer

Living Rich with Coupons

JANUARY 16, 2024

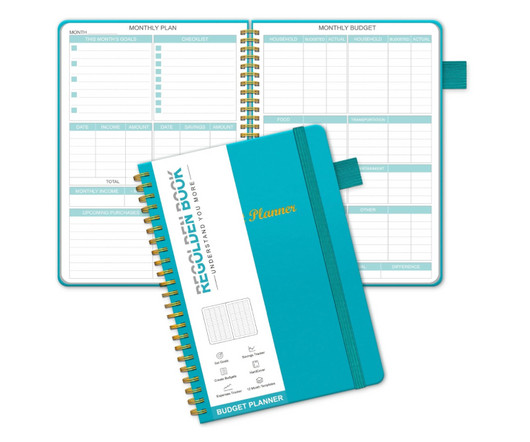

40% Off Regolden-Book Budget Planner – Undated Monthly Bill Organizer 40% off Code: C2VL5Q4O Description: ✍CREATE YOUR FINANCIAL FREEDOM – Keeping everything organized in Regolden Book Budget Planner. Get this deal at Amazon!

Let's personalize your content