Compound Interest: What It Is, Formula, Examples

Savings Corner

DECEMBER 24, 2023

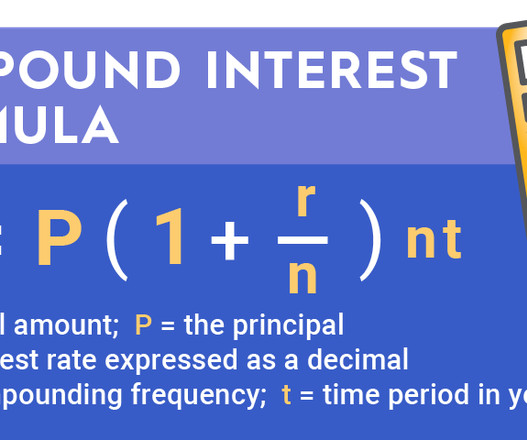

For example, if you invest $1,000 at 5% simple interest for 10 years, you can expect to receive $50 in interest every year for the next decade. In the investment world, bonds are an example of an investment that typically pays simple interest. For example, your savings account may calculate interest monthly.

Let's personalize your content