2023-2024 Tax Brackets and Federal Income Tax Rates

Savings Corner

DECEMBER 24, 2023

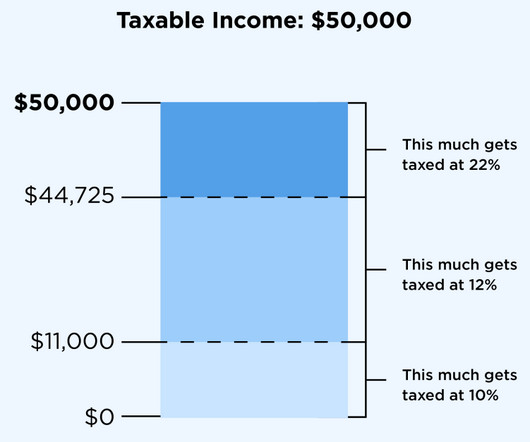

The total bill would be about $6,300 — about 13% of your taxable income, even though you’re in the 22% bracket. Two common ways of reducing your tax bill are credits and deductions. Tax credits can reduce your tax bill on a dollar-for-dollar basis; they don’t affect what bracket you’re in. Take a look back.

Let's personalize your content