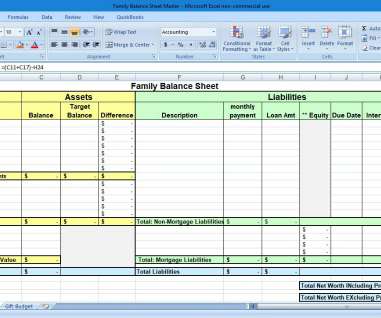

How to Create a Family Balance Sheet + Get a FREE one for your family!

Family Balance Sheet

AUGUST 21, 2020

You’ll know how much is in your checking and savings accounts and your retirement accounts. Debts still need to be paid, cars will need new parts, homes will need to be repaired, and kids will need braces. There was a time our spreadsheet reflected a lot of debt and not a lot of savings.

Let's personalize your content