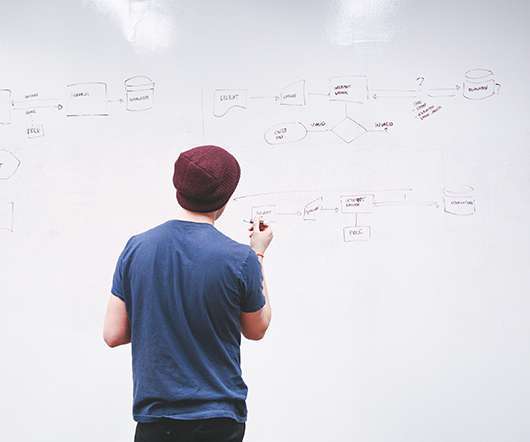

Create your debt freedom plan

Family Balance Sheet

APRIL 9, 2021

Many years ago, my husband and I faced what we thought was an insurmountable hurdle– six figures of non-mortgage debts. Stressed out, we ventured into Dave Ramsey’s online Financial Peace University home course for help. Prior to FPU, we thought we were doing well financially and never considered that we had too much debt.

Let's personalize your content