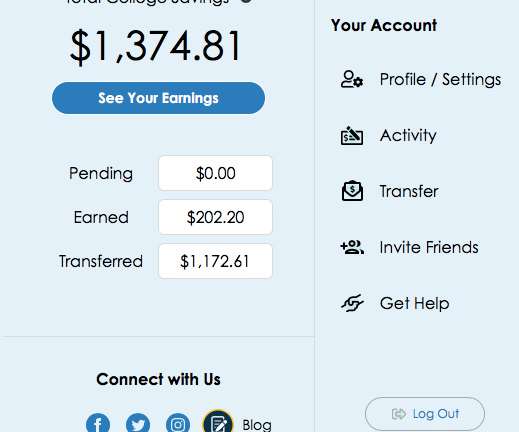

How We’re Using Upromise to Save for College

Family Balance Sheet

OCTOBER 15, 2021

I don’t recall why I never used the account, but I guess it just slipped my mind. Right before the pandemic started, I opened 529 College Savings Accounts for our daughters. My oldest was in eighth grade and one of my goals for 2020 was to start saving consistently for both daughters’ college education. Hello, 2020.

Let's personalize your content