10 Must-Know Personal Finance Tips for Moms’ Financial Success

Penny Pinchin' Mom

JANUARY 16, 2024

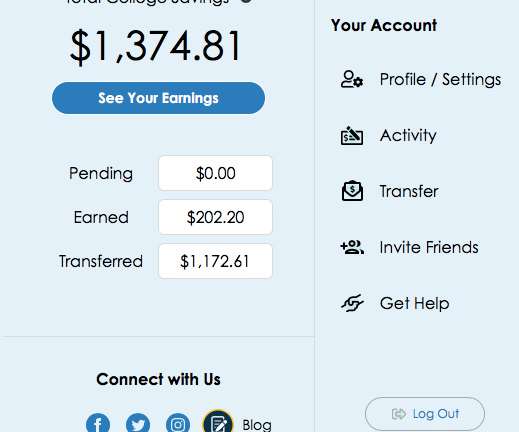

However, if you have been following me, you know that I am quite serious about finding ways to not only get out of debt but also how to create a budget (and stick to it) as well as how to save money without necessarily depriving your family of the quality of life they deserve. I send in $50 every month to each of their accounts.

Let's personalize your content