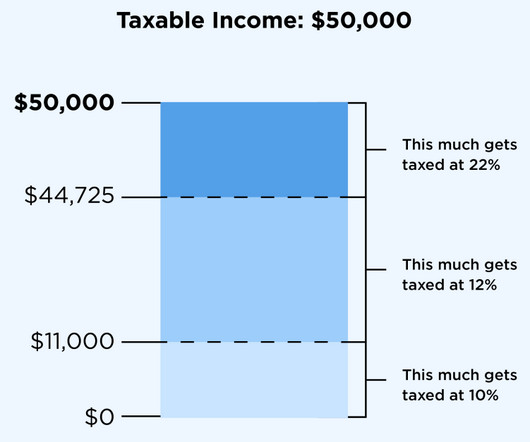

2023-2024 Tax Brackets and Federal Income Tax Rates

Savings Corner

DECEMBER 24, 2023

There are seven federal income tax rates in 2023 and 2024: 10%, 12%, 22%, 24%, 32%, 35% and 37%. federal tax rates will remain the same until 2025 as a result of the Tax Cuts and Jobs Act of 2017, but the income thresholds that inform the tax brackets are generally adjusted each year to reflect the rate of inflation [0].

Let's personalize your content